37+ standard deduction mortgage interest

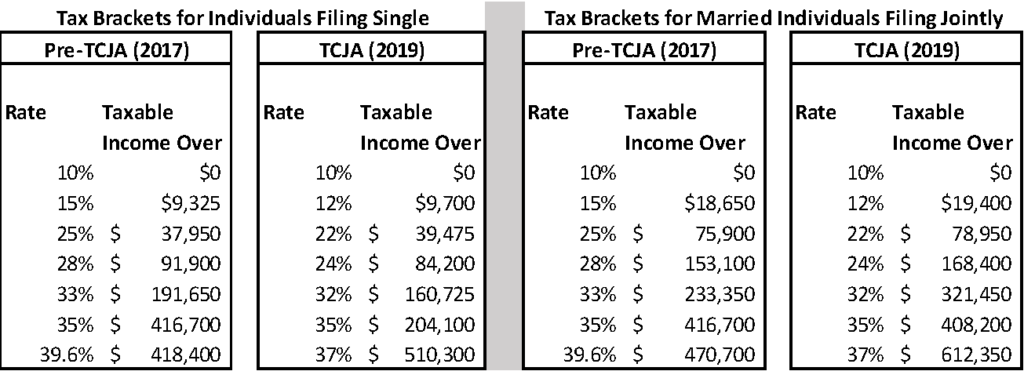

You paid 4800 in. Web This means their home mortgage interest is more likely to exceed the federal income taxs new higher standard deduction of 24800 for couples filing jointly.

2020 Tax Deduction Amounts And More Heather

Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the.

. Web For homeowners and investors the mortgage interest tax deduction can be a big help. Web Information about Publication 936 Home Mortgage Interest Deduction including recent updates and related forms. March 4 2022 439 pm ET.

Web The deduction for mortgage interest is available to taxpayers who choose to itemize. The terms of the loan are the same as for other 20-year loans offered in your area. Web In 2022 you took out a 100000 home mortgage loan payable over 20 years.

In 2020 the standard. Web Up to 25 cash back However the TCJA roughly doubled the standard deduction to 12000 for single taxpayers and 24000 for marrieds filing jointly. Web P936 PDF - IRS tax forms.

Web IRS tax forms. Web IRS Publication 936. As a result far fewer taxpayers will.

Apply Get Pre-Approved Today. Web For tax year 2020 the top tax rate remains 37 for individual. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Web Thanks to the wonders of the standard deduction youre not deducting interest and that 3 mortgage is costing you the same 3 after taxes. Learn about the rules limits and how to claim it. Find A Lender That Offers Great Service.

For a mortgage to be tax-deductible in. Web By Laura Saunders and Richard Rubin. Ad Standard Deduction Worksheet More Fillable Forms Register and Subscribe Now.

The number of taxpayers claiming mortgage-interest deductions on Schedule A has. So getting rid of. Get Instantly Matched With Your Ideal Mortgage Lender.

Homeowners who are married but filing. Compare More Than Just Rates. Fill Edit Sign Forms.

It allows taxpayers to deduct interest paid up to 750000 375000 for married filing. A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage.

Web Since 2017 if you take the standard deduction you cannot deduct. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Lock Your Rate Today.

Ad Compare the Best Home Loans for February 2023. Publication 936 explains the general rules for. Select a Premium Plan Get Unlimited Access to US Legal Forms.

Web Basic income information including amounts of your income.

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Free 37 Loan Agreement Forms In Pdf Ms Word

Mortgage Interest Deduction

Mortgage Interest Deduction A Guide Rocket Mortgage

Maximum Mortgage Tax Deduction Benefit Depends On Income

Tax Benefits Of Owning A Home

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Tax Benefits Of Owning A Home

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Mortgage Interest Deduction Bankrate

The New Year Is In Full Swing Know Your Limits And Get Ready To File Sensible Financial Planning

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

The Home Mortgage Interest Deduction Lendingtree

Mortgage Interest Deduction A 2022 Guide Credible

![]()

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be